Nigeria is the largest economy in Africa, and projected to become one of the world’s top 20 economies by 2030. Nigeria’s population of 218,541,212 million is also the largest in Africa. The country has a large base of young population – more than 54% of all males and 51% of all females are younger than 20 years of age. Nigeria records over 60% of European Union’s trade with West Africa.

Oil and Gas account for 90% of foreign exchange earnings and more than half of the government revenues. However, the country is endowed with huge natural resources such as bitumen, coal, columbite, copper, diamond, gold, iron-ore, lead, limestone, marble, salt, silver, tin, spread across its thirty-six States and the Federal Capital Territory (FCT). The rebasing of the country’s GDP in 2014 showed tremendous prospects in non-oil sectors, including, agriculture, IT, trade, entertainment and services. Consequently, the Federal Government through its flag-ship programme – Economic Recovery and Growth Plan and now, the National Development Plan 2021-2025 is diligently diversifying the economy with robust MSME growth, while consolidating the position of the private sector as the engine of the economy.

The Nigerian government is also investing in critical infrastructure, ensuring good gov-ernance, enabling a vibrant, educated and healthy populace, reducing poverty and ensuring regional economic and social dis-parities. Target economic areas are agricul-ture and food security, transportation, power, industrialization, infrastructure, employment. Several products such as cocoa, cotton, cement, leather, cashew, sesame, shea butter, palm oil, fertilizer, petrochemicals have been identified for export, with a view to strength-ening the economic base of the country.

Owing to Covid-19 pandemic, and external shocks, the Nigerian economy lapsed into recession in Q3 2020 after two succes-sive quarters of negative GDP growth but promptly emerged from the recession with a positive 0.11% growth in Q4 2020, a trend which continued into 2021 where it recorded a 5.01% GDP growth in Q2, 92% of which was from the non-oil sector.

NIGERIA: A STRONG INVESTMENT CASE:

- The country provides an attractive investment destination, backed by strong economic fundamentals for businesses to thrive.

- Remained Africa’s largest economy over the last seven years

- Geographical land mass bigger than France and UK combined. Also blessed with diverse natural resources

- Current monthly minimum wage is $83 compared to $233 in South Africa or $124 in Egypt

- Considered one of the ten most improved economies in the World Bank Doing Business Report 2020

- Largest market across Africa with a projected population of 402 million and the world’s 3rd largest population by 2050

- Per capita income of $2028.2 is 84% higher than Africa’s average of $1,720

- Home to many international brands who have recorded success operating in Nigeria such as PZ, GSK, Unilever, Diageo and MTN

- Financial market is one of the largest in Africa, with a capital market capitalization rate of over US40 billion

- Witnessed 20 years of uninterrupted democracy, sparring peaceful handover of five elected Presidents

- Federal government has provided numerous initiatives and policies to incentive investment across various sectors

- Projected to grow at a CAGR of 2.5% over the next five years

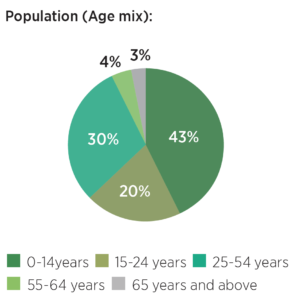

Nigeria has a very young, energetic, tech savvy and entrepreneurial population with over 50% of the total population below 25 years old.

Nigeria has a very young, energetic, tech savvy and entrepreneurial population with over 50% of the total population below 25 years old.

Source: Nigeria Investment Guide January 2020, UK Department of International Development, UK aid and Nigeria Investment Promotion Commission (NIPC)

INVESTMENT POTENTIAL AND OPPORTUNITIES IN NIGERIA

AGRICULTURE

Nigeria accommodates large tracks of arable land which makes agriculture an important sector of the economy. Agricultural sector contributes 25% of the Nigeria’s GDP. Crop production dominates the sector, accounting for 22.6% of GDP alongside livestock (17%) fisheries (0.5%) and forestry (0.3%). Investment opportunities are available in mechanized crop production; food processing and preservation; beef processing and packaging; fruit juice/canned fruits; beverages and confectionary; cash crop processing; exploitation of timber and wood processing; livestock; horticulture development; agricultural input supplies and machinery; water resources development and fabrication of appropriate small scale mechanized technologies; development of private irrigation facilities; production of improved seeds and agro-chemicals; production of veterinary drugs and market research.

INDUSTRY

Nigeria is a natural location for a variety of industrial activities due to the availability of natural resources, affordable labour cost and large market. It produces a large proportion of goods and services for the West African region. The industry sector contributes an annual average of 23% of the GDP. The major activities include, oil and gas (9%), manufacturing (7%), and construction (5%).

OIL AND GAS

Nigeria ranks as the largest oil producer in Africa and has the largest gas reserves in the Continent. The State owned Nigerian National Petroleum Company, recently restructured, accounts for more than 50% of oil production and over 40% of gas supply. The local refining capacity is put at 24%. This creates a huge gap between the demand for refined petroleum products and local supply. Towards bridging the gap, the downstream sector has been opened to private sector participation. In this regard, Dangote Petroleum Refinery is being constructed in Lagos, likely to become Africa’s biggest oil refinery and world’s biggest single train facility.

MANUFACTURING

Lagos and its environs are home to about 60% of Nigeria’s industrial activities. Other industrial cities include Kano, Aba, Ibadan, Port-Harcourt and Kaduna. Nigeria’s major manufacturing industries include beverages, cement, food processing, textile and detergents. The sector contributes about 9% of the GDP annually.

CEMENT

Nigeria is becoming home to the world’s largest emerging cement companies. Two companies, Dangote Cement and Lafarge WAPCO Cement control 80% of the market. Nigeria is almost meeting its local demand and the industry is beginning to export to neighboring countries.

SERVICES

Nigeria is one of the most open services market in Africa. Services account for 53% of the country’s GDP. The main contributory services are trade (16%), information and communication (18%), real estate (6%), professional, scientific and technical services (4%), and financial and insurance (3%). The prospects of the market are strong with 49% of the population being internet – savvy Nigerians with the largest online market for apparel and footwear in Africa.

INFORMATION AND COMMUNICATION

Nigeria is home to the fastest growing and largest telecommunications industry in Africa with a population of over 216 million, about 49% being active internet users, ICT industry presents attractive investment opportunities especially in private network links, internet business and satellite communication, payphone services and cellular radio phone services.

OTHER SECTORS

The Nigerian Financial and Insurance industries have become more diversified and stronger, as many Nigerian banks now operate in most African countries. The Brewing industry, Food processing, Textile, Health (especially specialist care), Education, Housing, Real estate, Solid minerals are also sectors with strong prospects.

![[:en]Test[:]](https://perspectives-cblacp.eu/wp-content/uploads/2022/10/Test-696x385.jpg)