As one of the fastest-growing economies in the world this year, Ghana draws a lot of attention in the media and from investors as it aims to lead a new wave of private sector-driven industrialization throughout the country. The peaceful elections that were held in 2016 and solid social capital pave way for a bright future coloured by many investment opportunities in the fields of agriculture, health, tourism to name a few. The investment climate is positive, and an increased ease of doing business has seen many foreign investors play their cards.

Sitting on the Atlantic Ocean, Ghana has taken major strides towards democracy under a multi-party system in the past two decades according to the World Bank. Consistently ranking in the top three countries for freedom of speech and press freedom, as well as improving the ease-of-doing business through reforms, Ghana has built a solid social capital according to the WB.

The President Akufo-Addo was elected in 2016 with 54% of the vote. Akufo-Addo ran on a on a pro-business platform that proposed to re-ignite growth and create jobs by bringing in new industries, as well as making the government more inclusive and accountable.

The Five Strategic Goals of the Long-term Plan

- Create an industrialised, inclusive and resilient economy

- Build an equitable, healthy and prosperous society

- Build well-planned and safe communities while protecting the natural environment

- Build effective, efficient and dynamic institutions for national development

- Strengthen Ghana’s role in international affairs

A private sector led industrialized relaunch

The relaunch of Ghana’s economy after difficult years has been based on the reinforcement of industry and the private sector though investment in education, infrastructure, the development of agriculture, and the restructuring of the mining sector. One of the main electoral promises of the President was the “one district, one factory” policy which aims to bring at least one manufacturing or processing facility to all 216 districts in the country.

The Ghana Investment Promotion Centre’s Chief Officer has repeatedly affirmed that the first main aim of the policy is to use the natural resources of the districts in order to produce goods both for export and local consumption. The main challenges for the realisation of this policy remain access to transportation and energy distribution. Until these issues are resolved, the implementation of the “one district, one factory” initiative will be challenging. In order to overcome this challenge, the Ghana Investment Promotion Centre has set out to attract foreign investment to these through the creation of interesting tax rebates and incentives that will make the projects competitive. A special focus has been set on four priority areas for foreign investment: energy, infrastructure, agro-processing and tourism.

Macro-economics are encouraging, with the total public debt down to 64% from 67% in 2017, the deficit has been reined from 9 to a projected 4,5% accompanied by a tax rise for top earners from 25 to 35%. The economic growth is projected at 6.8% for 2018, thanks to strong performances in the oil and farming sectors, and inflation has decreased from 17 to 10%. A strong action plan to clean up the banking sector was led by the authorities, paving the way for a stronger Central Bank led by a new governor, Ernest Addison. A new state-managed entity, Consolidated Bank regrouped five banks and two banks were closed.

The government’s plan, however, still faces the challenge of reforming dozens of state-owned enterprises in order to accelerate the slow progress of the establishment of factories in all 216 districts.

Authorities need to examine over 1.000 factory proposals, of which about 60% are for agricultural processing. The policy foresees that private business can ask the authorities for help to make the factories profitable. Power supply and road infrastructure are the two main challenges that need to be addressed, together with loans at reasonable rates via commercial banks and tax rebates. At this stage, over 60% of the proposals have been examined.

Full oil exploitation, broad growth

The end of the international maritime border dispute between Ghana and the Ivory Coast in 2017 opened the possibility for Tullow to exploit oil production in Ghana from the offshore plants Tweneboa, Enyenra and Ntomme fields to its full capacity of 80.000 barrels a day by 2020. This exploitation had been put on hold because of the dispute for two years. The complete TEN project will consist of 24 wells in total which also include other companies: Kosmos Energy, Anadroka Petroleum Corp, Ghana National Petroleum Corp and Petro SA. The TEN fields have reserves estimated at 240 million barrels of oil and associated gas of 60 million barrels and produce currently around 56.000 barrels, according to the external affairs director Cynthia Lumor of Tullow Oil in Accra. The Jubilee oil field, Ghana’s flagship 120 000 barrel per day production, is also operated by the consortium and has a 800 million barrel reserve. These prospects will definitely have positive effects on the economy.

Export for cocoa

Cocoa is Ghana’s main chief agricultural export and main crop. The country is the second largest cocoa exporter in the world next to the Ivory Coast, accountable for a 950 000 tonnes production for 2017 and an estimated 700.000 tonnes for 2018, due to poor rains. These figures represent 25% of global cocoa supply and the industry also contributes around 7% of GDP as well as up to one quarter of the country’s export earnings.

This important sector to the Ghana economy is set to develop further in the years to come with the installation of a new Cocoa Processing Factory at Sefwi Wiawo in the Western Region of Ghana, for a cost of 60 million USD. The Ghana Cocoa Board (Cocobod) secured funds through a 35 million USD Chinese Exfimbank grant and 25 million USD investment from the Government of Ghana, this plant is expected to process 40.000 tons of cocoa beans annually.

Joseph Boahen Aidoo, the CEO of Cocobod said that “the conventional cocoa market in Europe and America has become stagnant but there is a new consumption pattern emerging in Asia…”. Cocobod is also trying to secure an extra 1,5 billion USD from the Chinese bank to further increase its cocoa production.

Energy infrastructures

The Strategic National Energy Plan 2006-2020 aims to develop a sound energy market that would provide sufficient, viable and efficient energy services for Ghana’s economic development through the formulation of a comprehensive plan that will identify the optimal path for the development, utilization and efficient management of energy resources available to the country. Since 2016, a major focus has been set on improving the energy infrastructure and its public operators.

The energy sector is divided into two main sectors: petroleum and power. The Power System of Ghana is run by seven public institutions. These are the Ministry of Power (MOP), Energy Commission (EC), Public Utility Regulatory Commission (PURC), Volta River Authority (VRA), Ghana Grid Company (GridCo), Electricity Company of Ghana Limited (ECG) and the Northern Electricity Department Company (NEDCo), a subsidiary of the VRA.

Electricity generation is undertaken by the state-owned Volta River Authority (VRA), which operates the Akosombo Hydro Power Station, Kpong Hydro Power Station and the Takoradi Thermal Power Plant (TAPCO) at Aboadze for a total of

2,340 MW. Independent Power Producers and other plants account for 1,935 MW, bringing the total installed capacity in Ghana to 4,275 MW.

Works on the electric powerplant of Téma have started (400 MW) and represent a total investment of 1 billion USD. The works are undertaken by the consortium Early Poer Ldt composed of Endeavor Energy, Sage, General Electric and Denham Capital. Two more solar energy plants of 20 MW based in Temalé in the Volta bassin have also started. Another priority of the government is to restructure the public operators in this sector whose debt is estimated at 2,4 billion USD. For example, the government prefers to privatize the Electricity company of Ghana.

Renewable energies are not yet highly used and opportunities exist for foreign investor to invest in areas such as street lighting, improving coverage and access, improving service efficiency but also providing alternative decentralized sustainable energy systems that can easily be deployed in remote and deprived communities into the overall national energy mix, solar energy system for schools in off-grid communities.

Maritime infrastructures

Ghana has two commercial ports: one at Tema, in the east and the other at Takoradi in the west. An inland port is under construction at Boankra, near Kumasi.

A hub for airlines in West Africa

Situated 9 km to the north of Accra, Kotoka International Airport (ACC) is the country’s primary international airport and one of only five airports in Africa to have Federal Aviation Administration (FAA) accreditation to operate flights directly to the United States. This Ghanaian airport sees more than 1.5 million visitors each year and offers services and facilities that are in line with international standards.

The brand-new Terminal 3, build by the Turkish construction company Mapa Construction MNG Holding for a cost of 275 million USD has been in use since September 15 and was inaugurated on October 2nd. The new 44,983 m² terminal is designed for international traffic and will include five levels in the main terminal building as well as a CIP Terminal incorporated into the facility. The building is designed to meet the latest International Air Transport Association (IATA) requirements based on “optimum” level-of-service and will accommodate five million passengers per year on the six-fixed linked contact stands as well as two additional remote stands.

The arrival level will offer 28 immigration counters plus four e-gate positions and four reclaim devices. The baggage handling system will be automated and designed to be compliant with the latest European Civil Aviation Conference Hold Baggage Screening (ECAC HBS) requirements.

International seduction

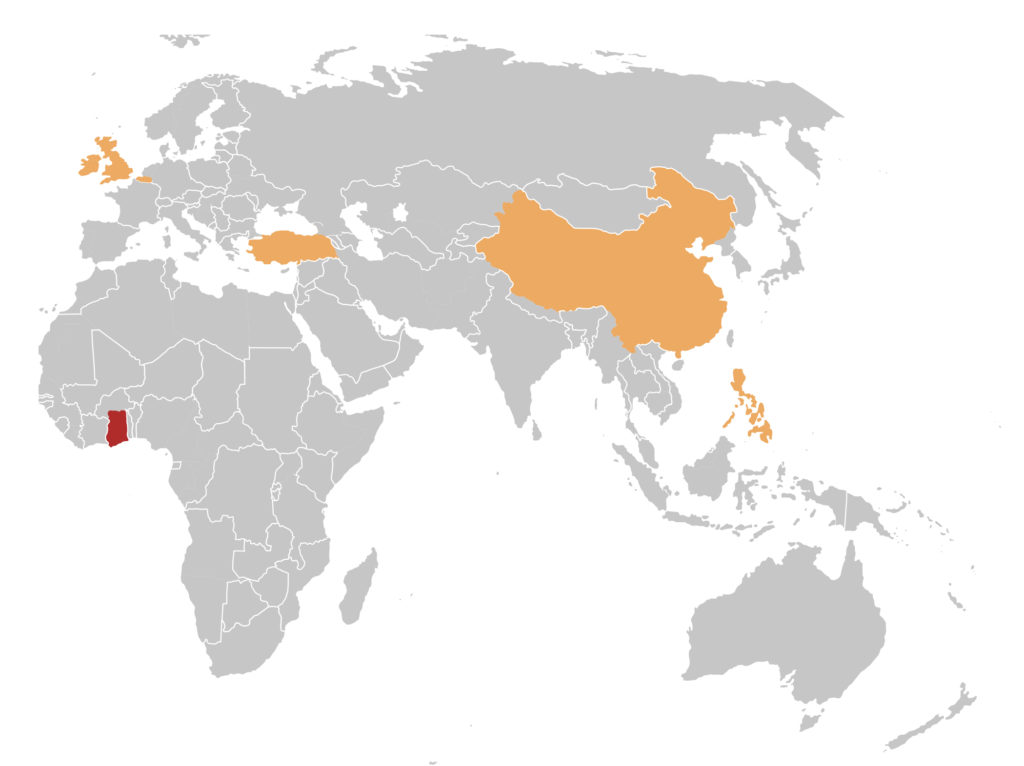

As one of the fastest growing economies in Africa, Ghana has been courtisaned by many international powers. A Turkish company is now generating part of Ghana’s power while another Turkish company finished the new terminal of the Kotoka International Airport. A Philippine utility is trying to take over the Electricity Company of Ghana, the largest distributor in west Africa. As for China, they have been leading the way for the past decade. Recently, the United Kingdom sent Theresa May on a three-nation tour of Africa to prepare the post-Brexit world. While Europe remains the number one global trade partner with Sub-Saharan Africa, China is closing in and already outnumbers the US. From 2018 – 2035, the UN predicts that world 10 fastest growing cities will all be African.

As one of the fastest growing economies in Africa, Ghana has been courtisaned by many international powers. A Turkish company is now generating part of Ghana’s power while another Turkish company finished the new terminal of the Kotoka International Airport. A Philippine utility is trying to take over the Electricity Company of Ghana, the largest distributor in west Africa. As for China, they have been leading the way for the past decade. Recently, the United Kingdom sent Theresa May on a three-nation tour of Africa to prepare the post-Brexit world. While Europe remains the number one global trade partner with Sub-Saharan Africa, China is closing in and already outnumbers the US. From 2018 – 2035, the UN predicts that world 10 fastest growing cities will all be African.

Bilateral relations

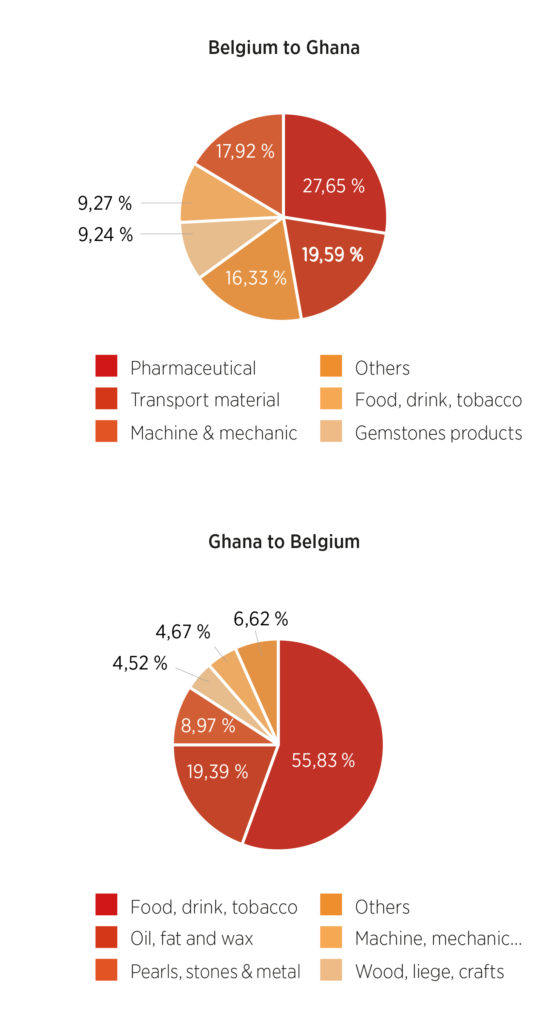

Belgium and Ghana have a long-standing relation. The country is ranked 71st on our export list and represents a total of 174,79 million Euros exported to Ghana that are distributed as follows:

- pharmaceutical productions and products of chemical industries: 27,65%

- transport material: 19,59%

- machine and mechanic, electrical and electronic equipment’s: 17,92%

- food, drink and tobacco: 9,27%

- gemstones products: 9,24%

Belgian export to Ghana have seen an impressive increase of 30,11%, mainly due to the 79.93% increase in exports of chemical and pharmaceutical products.

On the other hand, Ghana is the 88th supplier of Belgium. In 2017, Belgium imported 60,68 million Euros of goods distributed as follows:

- foods, drinks and tobacco: 55,83%

- oil, fat and wax (animal and plant-based): 19,39%

- pearls, stones and precious metal, coins: 8,97%

- machine and mechanic, electrical and electronic equipment’s: 4,67%

- wood, Liege, crafts: 4,52%

Imports from Ghana have diminished by 36% in comparison to the previous year, mainly due to a 53,62% decrease in food, drinks and tobacco.

A Belgian economic mission organised by Regional Foreign Trade Agencies AWEX, FIT and HUB Brussels took place in Guinea and Ghana from December 4 – 8th.

Discover the report of the economic mission in Ghana on https://www.businessghana.com/site/news/business/178266/Ghana-and-Belgium-explores-investment-opportunities

![[:fr]AFRICA'S BLACK STAR[:]](https://perspectives-cblacp.eu/wp-content/uploads/2018/12/AFRICAS-BLACK-STAR-696x391.jpg)